Maximize Your Wealth with Automated Investments in Leading ETFs

Investing in the stock market can seem intimidating, but with modern investment platforms, it’s easier than ever to start building wealth. One effective strategy is to set up an automatic investment account, where your money is regularly invested in a choice of ETFs (Exchange-Traded Funds). This blog post will guide you through setting up an investment account, automating your investments, and understanding the long-term benefits of this strategy. We’ll use Robinhood as an example to illustrate the process.

“The best time to plant a tree was 20 years ago. The second best time is now.” – Chinese Proverb

Setting Up Your Investment Account

To begin, you’ll need to create an investment account on a platform like Robinhood. Follow these steps to get started:

- Choose Your Investment Platform:

- Popular options include Robinhood, E*TRADE, and Fidelity. For this guide, we will use Robinhood as an example. You can sign up using my referral link.

- Download the App:

- Download the investment platform app from the App Store or Google Play.

- Sign Up for an Account:

- Open the app and click on the “Sign Up” button. You’ll need to provide personal information such as your name, email address, and social security number for verification.

- Link Your Bank Account:

- To fund your investments, you’ll need to link your bank account. This allows you to transfer money to your investment account seamlessly.

- Enable Two-Factor Authentication:

- For added security, enable two-factor authentication to protect your account from unauthorized access.

Automating Your Investments

Once your account is set up, you can automate your investments to ensure a consistent contribution to your portfolio. Here’s how:

- Set Up Recurring Deposits:

- Navigate to the “Account” tab and select “Transfers.” Choose “Recurring Deposits” and set the amount you want to deposit into your investment account each week. For this example, we’ll set up a $100 weekly deposit.

- Select Your ETFs:

- Most investment platforms offer a wide range of ETFs. For this strategy, we’ll focus on three types of funds: a broad market ETF (such as VOO – Vanguard S&P 500 ETF), a sector-specific ETF (such as VGT – Vanguard Information Technology ETF), and a dividend-focused ETF (such as VIG – Vanguard Dividend Appreciation ETF).

- Automate Your Purchases:

- Use the platform’s “Recurring Investments” feature to automatically buy shares of your selected ETFs. Divide your $100 weekly deposit as follows:

- $50 to a broad market ETF (e.g., VOO)

- $25 to a sector-specific ETF (e.g., VGT)

- $25 to a dividend-focused ETF (e.g., VIG)

- Use the platform’s “Recurring Investments” feature to automatically buy shares of your selected ETFs. Divide your $100 weekly deposit as follows:

- Monitor and Adjust:

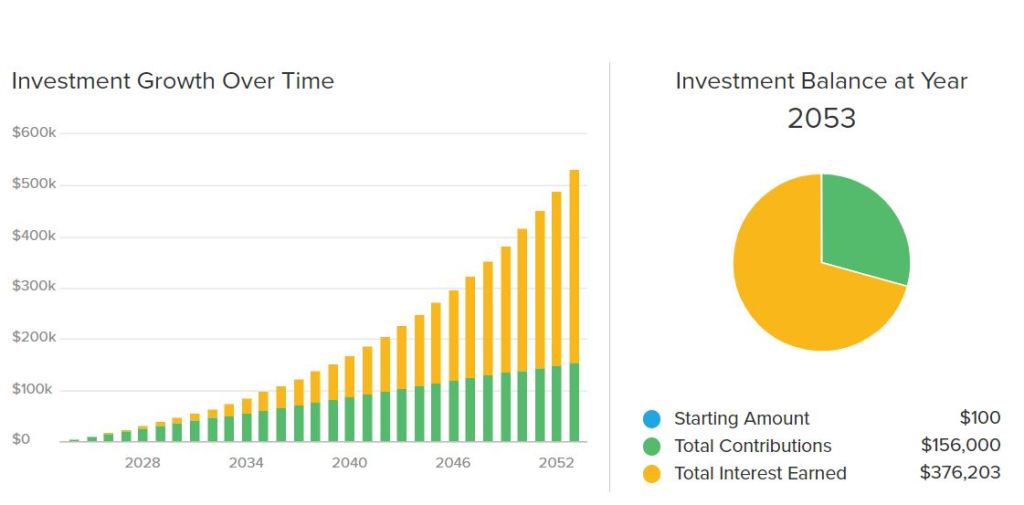

- Periodically review your investments and adjust your contributions as needed to stay aligned with your financial goals. Play or change the starting or weekly contributions and the percentage growth using this calculator.

Benefits of Automatic Investing

Automatic investing offers several advantages, especially when maintained over a long period:

- Consistency:

- By automating your investments, you ensure that you’re consistently contributing to your portfolio, regardless of market conditions.

- Dollar-Cost Averaging:

- Investing a fixed amount regularly means you’ll buy more shares when prices are low and fewer when prices are high, potentially lowering your average cost per share over time.

- Compound Interest:

- Over the long term, the returns on your investments can generate their own returns, leading to exponential growth. Albert Einstein famously called compound interest the “eighth wonder of the world.”

- Reduced Emotional Investing:

- Automation removes the emotional aspect of investing, helping you stick to your plan without being swayed by market volatility.

Long-Term Growth Potential

The power of compound interest cannot be overstated. For example, if you invest $100 weekly ($400 monthly) into a portfolio with an average annual return of 7%, after 20 years, you could potentially grow your investment to over $200,000. This is the magic of long-term investing and compound interest at work.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” – Albert Einstein

Conclusion

Setting up an automatic investment account with a platform like Robinhood is a smart and straightforward way to build wealth over time. By regularly investing in ETFs like VOO, VGT, and VIG, you can take advantage of dollar-cost averaging and compound interest to grow your portfolio. Start today and watch your investments flourish.

For more on financial independence, read our post on how to achieve financial freedom. Check out our article on top side hustles to boost your income.

Leave a reply to Master Your Finances: 10 Steps to Build a Solid Financial Plan – Escape the Race Cancel reply