Discover Strategies for Earning Income with Minimal Effort

In the quest for financial freedom and a balanced lifestyle, passive income stands out as a powerful tool. It allows you to earn money with minimal ongoing effort, enabling you to focus on what truly matters. On “Escape the Race,” we delve into various passive income ideas that can help you make money while you sleep, freeing you from the constant grind and bringing you closer to your financial goals.

“The key to financial freedom and great wealth is a person’s ability or skill to convert earned income into passive income.” – Robert Kiyosaki

What is Passive Income?

Passive income is money earned with little to no daily effort required. Unlike active income, which involves trading time for money, passive income streams continue to generate revenue even when you’re not actively working. This type of income can provide financial stability and greater freedom to pursue your passions.

Benefits of Passive Income

- Financial Security: Diversifying your income streams reduces reliance on a single source of income.

- Flexibility: More time to focus on personal interests, hobbies, or other business ventures.

- Scalability: Potential to earn more without significantly increasing your workload.

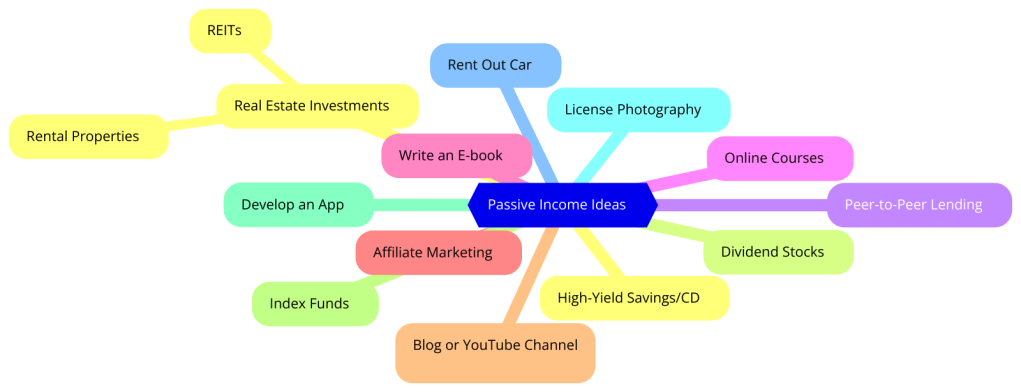

Passive Income Ideas

- Real Estate Investments

- Rental Properties: Purchase properties to rent out to tenants. Rental income can provide a steady stream of cash flow.

- REITs: Real Estate Investment Trusts allow you to invest in real estate without owning physical properties. REITs pay dividends from rental income and property sales.

- Dividend Stocks

- Invest in stocks that pay regular dividends. This income can be reinvested or used as a steady cash flow. Look for companies with a history of consistent dividend payments.

- Peer-to-Peer Lending

- Platforms like LendingClub or Prosper allow you to lend money to individuals or small businesses. In return, you earn interest on the loans, providing a passive income stream.

- Create and Sell Online Courses

- Share your expertise by creating online courses on platforms like Udemy, Teachable, or Coursera. Once created, courses can be sold repeatedly without additional effort.

- Write an E-book

- Author an e-book on a topic you’re passionate about. Publish it on platforms like Amazon Kindle Direct Publishing (KDP) and earn royalties from sales.

- Affiliate Marketing

- Promote products or services through your blog, website, or social media. Earn a commission for every sale made through your referral links. Programs like Amazon Associates and ShareASale are great places to start.

- Create a Blog or YouTube Channel

- Build a blog or YouTube channel around a niche you love. Monetize through ads, sponsored content, and affiliate marketing. Consistent content creation can lead to long-term passive income.

- Invest in Index Funds

- Index funds are a type of mutual fund that tracks a specific market index. They offer low fees and steady returns over time, making them a great option for passive investors.

- Develop an App

- If you have tech skills, consider developing a mobile app. Apps can generate revenue through ads, in-app purchases, or a one-time purchase fee.

- License Your Photography

- If you’re a photographer, license your photos to stock photo websites like Shutterstock or Getty Images. Earn royalties each time your photo is downloaded.

- Rent Out Your Car

- Platforms like Turo allow you to rent out your car when you’re not using it. This can turn an idle asset into a source of passive income.

- Invest in a High-Yield Savings Account or CD

- While not as high-yield as other options, a high-yield savings account or certificate of deposit (CD) offers low-risk passive income through interest.

“If you don’t find a way to make money while you sleep, you will work until you die.” – Warren Buffet

Getting Started with Passive Income

- Research and Choose Wisely

- Assess your interests, skills, and risk tolerance. Research each passive income idea thoroughly before investing time or money.

- Start Small

- Begin with one or two passive income streams. As you gain confidence and experience, you can diversify and expand your efforts.

- Automate Where Possible

- Use automation tools to manage and grow your passive income streams. For example, use investment apps for automated investing or scheduling tools for content publishing.

- Be Patient

- Building passive income takes time and effort initially. Be patient and stay consistent with your efforts.

Conclusion

Passive income is a powerful way to achieve financial freedom and escape the conventional rat race. By exploring and implementing these passive income ideas, you can create a more flexible, secure, and fulfilling financial future. At “Escape the Race,” we encourage you to take the first step towards building your passive income streams and enjoy the benefits of earning money while you sleep.

Leave a reply to Comprehensive Guide to Retirement Planning: Steps for a Secure Future – Escape the Race Cancel reply