Effective Strategies to Simplify Your Budget and Achieve Financial Freedom

Creating a minimalist budget is an effective way to simplify your finances and focus on what truly matters. By eliminating unnecessary expenses and prioritizing your financial goals, you can achieve financial freedom and peace of mind. This guide will help you create a minimalist budget that aligns with your lifestyle and goals.

Balancing your money is the key to having enough. – Elizabeth Warren

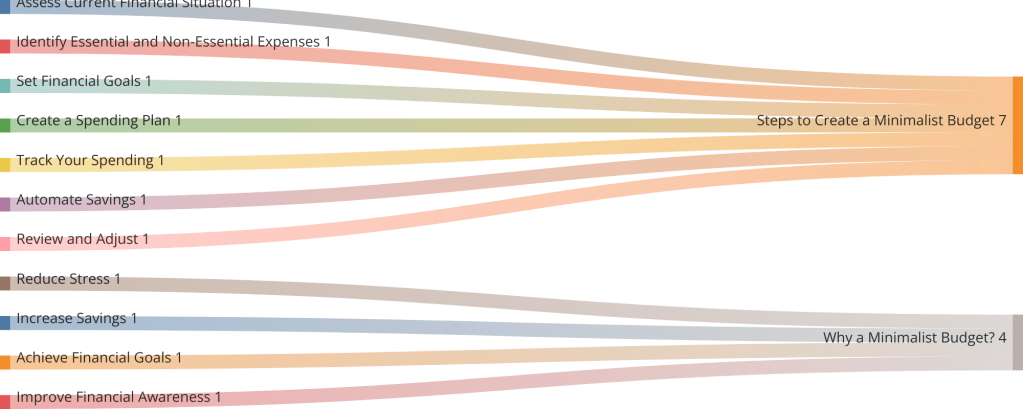

Why a Minimalist Budget?

- Reduce Stress: Simplifying your finances can reduce the stress and anxiety associated with money management.

- Increase Savings: By cutting out unnecessary expenses, you can increase your savings and invest in your future.

- Achieve Financial Goals: A minimalist budget helps you focus on your financial goals and prioritize spending accordingly.

- Improve Financial Awareness: Tracking your expenses and income enhances your financial awareness and decision-making.

Steps to Create a Minimalist Budget

1. Assess Your Current Financial Situation

Start by evaluating your current financial situation. List all sources of income and track your expenses for a month. This will give you a clear picture of your spending habits and areas where you can cut back.

2. Identify Essential and Non-Essential Expenses

Categorize your expenses into essential (needs) and non-essential (wants). Essential expenses include housing, utilities, groceries, transportation, and insurance. Non-essential expenses include dining out, entertainment, and luxury items.

3. Set Financial Goals

Define your short-term and long-term financial goals. These could include saving for an emergency fund, paying off debt, or investing for retirement. Having clear goals will help you stay focused and motivated.

4. Create a Spending Plan

Based on your essential expenses and financial goals, create a spending plan that allocates your income accordingly. Ensure that your spending aligns with your priorities and eliminates unnecessary expenses.

5. Track Your Spending

Regularly track your spending to ensure you stay within your budget. Use budgeting apps or spreadsheets to monitor your expenses and make adjustments as needed.

6. Automate Savings

Set up automatic transfers to your savings and investment accounts. Automating your savings ensures you consistently save money without having to think about it.

7. Review and Adjust

Periodically review your budget and make adjustments as needed. Life changes, such as a new job or a significant expense, may require you to modify your budget.

Practical Tips for Minimalist Budgeting

1. Embrace the 50/30/20 Rule

Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This simple rule helps you balance your spending and savings.

2. Limit Subscriptions

Review and cancel any unused or unnecessary subscriptions, such as streaming services or gym memberships.

3. Shop Mindfully

Avoid impulse purchases by creating a shopping list and sticking to it. Consider whether each purchase aligns with your financial goals.

4. Cook at Home

Reduce dining out expenses by cooking meals at home. Meal planning and prepping can save both time and money.

5. Buy Used or Borrow

Consider buying used items or borrowing instead of purchasing new. This can save money and reduce environmental impact.

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

Real-Life Examples and Practical Tips

Discover the Benefits of Minimalism: Simplify Your Life & Reduce Stress

Minimalism and budgeting go hand-in-hand. By adopting minimalist principles, you can simplify your finances and focus on what truly matters. (Refer to our post on Discover the Benefits of Minimalism)

Practical Steps to Achieve Financial Independence: A Complete Guide

Achieving financial independence requires disciplined budgeting and mindful spending. Learn how to create a budget that supports your financial independence goals. (Refer to our post on Practical Steps to Achieve Financial Independence)

Comprehensive Guide to Retirement Planning: Steps for a Secure Future

Effective budgeting is crucial for retirement planning. Learn how to create a budget that ensures a secure and comfortable retirement. (Refer to our post on Comprehensive Guide to Retirement Planning)

Conclusion

Creating a minimalist budget is a powerful step towards achieving financial freedom and peace of mind. By focusing on essential expenses, setting clear financial goals, and tracking your spending, you can simplify your finances and make room for what truly matters. Start your minimalist budgeting journey today and enjoy the benefits of a simplified, stress-free financial life.

Leave a comment